how much state tax do you pay on a 457 withdrawal

Employers or employees through salary reductions. Use the Filing Status and Federal Income Tax Rates table to assist you in.

Retirement Plan Withdrawal Clarification Chicago Teachers Union

Married Filing Jointly or Qualified Widow er Single.

. In most circumstances an early withdrawal triggers a penalty equal to 10 percent of the withdrawal amount. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return.

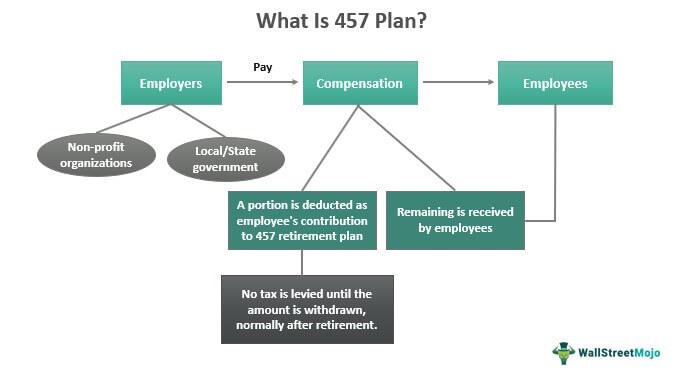

How do 457b plans work. Nonperiodic distributions from an employers retirement plan such as 401 k or 403 b plans are subject to withholding for federal income tax at a flat rate of 20. A 50 nondeductible excise tax.

If you have a 457b you can withdraw the budget from your account without any early withdrawal penalty. Theres a hefty penalty for failing to take a required minimum distribution. Call 988 then Press 1.

Furthermore it reduces the amount of money that grows and generates compound. If you are a veteran or are concerned about a veteran who is in distress contact the Veterans Crisis Line 24 hours a day 365 days a year. Please note that state taxes are entered in a separate entry field.

You cant put the money back. However if you save on the 403b you will receive a 10 penalty. 5 457 b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457 b plans.

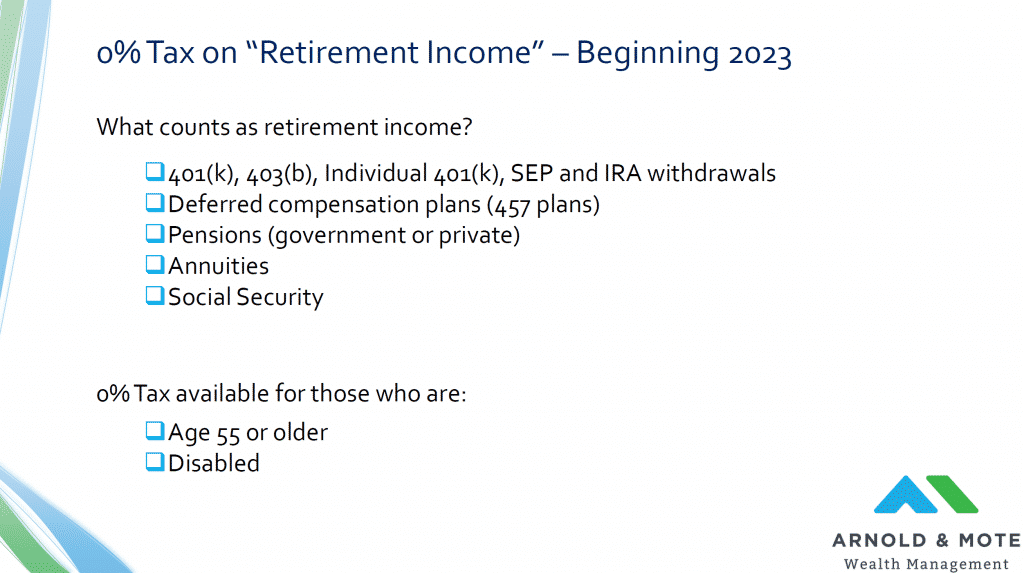

Please note that state taxes are entered in a separate entry field. CA DE OR Stateincome tax withholdingisrequiredwhenfederalwithholding applies unlessyouinstructus not to withhold state income taxes by selecting Do Not Withhold in. Withdrawals are generally taxable but unlike other retirement accounts the 10 penalty tax does not apply to.

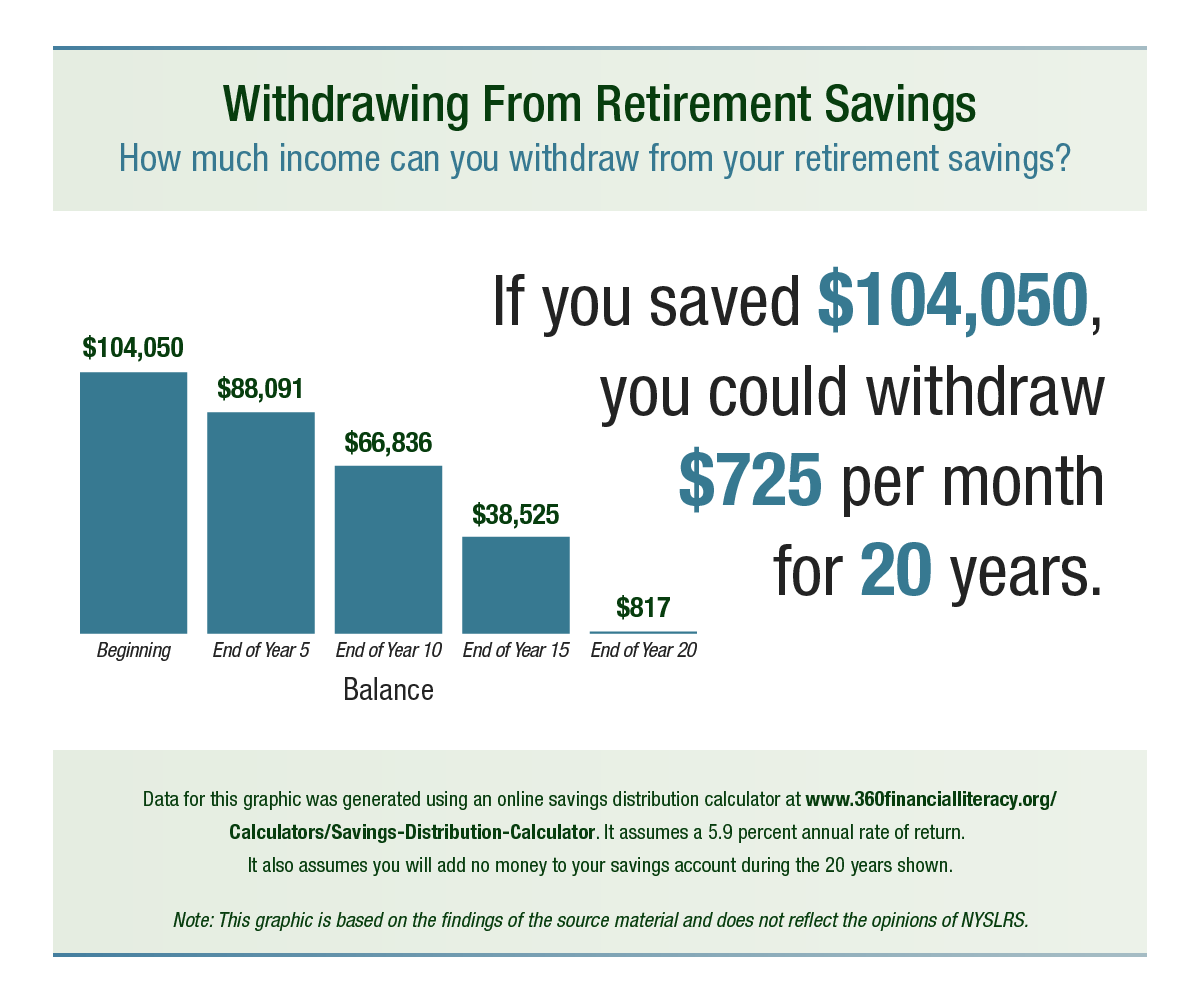

You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal. If you have a 457 f plan at a private non-profit be prepared. Its a permanent withdrawal from your TSP account.

Use the Filing Status and Federal Income Tax Rates on Taxable Income. How Much Tax Do You Pay on a 457b Withdrawal. If you are unsure the calculator will choose 25.

The organization must be a state or local government or a tax-exempt organization under IRC 501c. However distributions received after the pensioner turned 59 12 would. The IRS will impose a 10 percent penalty on early withdrawals from a traditional IRA or 401k for example but not a 457 plan from which you can take penalty-free distributions beginning at.

If you are unsure the calculator will choose 25. How much tax do you pay on a 457 withdrawal. Do not use these tax rate schedules to figure 2021 taxes.

For example if you fall in the 12. For example if you withdraw 10000 you must pay your taxes and. Can you withdraw money from 457b.

Are distributions from a state deferred section 457 compensation plan taxable by New York State.

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

Credit Union 457 B Deferred Compensation Plan Rbfcu

How Can I Get My 401 K Money Without Paying Taxes

457 B Island Savings Plan Pre Tax Office Of Human Resources

What Are Defined Contribution Retirement Plans Tax Policy Center

How Cares Act Eases Retirement Account Rules Forbes Advisor

Deferred Compensation County Of Fresno

457 Plan And Cryptocurrency Bitcoin Rollover Options Bitira

Does Illinois Require You To Pay State Taxes On An Ira Withdrawal

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

457 Plan Withdrawal Calculator

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

New York State Deferred Compensation Plan Archives New York Retirement News

457 Deferred Compensation Plan Emergency Withdrawal Packet Pdf Free Download

Supplemental Retirement Savings Plan Options Rankin County School District